A Beginner’s Guide.

In the ever-evolving landscape of finance and technology, few phenomena have captured the world’s attention quite like cryptocurrency. Born out of the digital revolution, cryptocurrency represents a paradigm shift in how we perceive and interact with money. But what exactly is cryptocurrency, and how does it work? In this beginner’s guide, we’ll delve into the basics of cryptocurrency, exploring its origins, underlying technology, and potential impact on the future of finance.

- Article content:

- Navigating the World of Cryptocurrency.

- The Top 3 Platforms for Cryptocurrency Trading.

What is Cryptocurrency?

At its core, cryptocurrency is a form of digital or virtual currency that uses cryptography for security and operates independently of any central authority. Unlike traditional fiat currencies issued by governments, such as the US dollar or euro, cryptocurrencies are decentralized and typically rely on blockchain technology to record transactions and manage the issuance of new units.

The most well-known cryptocurrency is Bitcoin, which Satoshi Nakamoto, an anonymous person or group, introduced in 2009. Since then, thousands of alternative cryptocurrencies, often referred to as altcoins, have been created, each with its own unique features and purposes.

How Does Cryptocurrency Work?

Cryptocurrencies like Bitcoin operate on a distributed ledger called the blockchain. A blockchain is a decentralized database that records all transactions across a network of computers, known as nodes. Each transaction is verified by these nodes and added to a “block” of transactions, which is then linked to the previous block, creating a chain of blocks — hence the name blockchain.

One of the key features of blockchain technology is its transparency and immutability. Once a transaction is recorded on the blockchain, it cannot be altered or deleted, making it resistant to fraud and tampering. Additionally, cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units.

Buying and Storing Cryptocurrency

If you’re interested in buying cryptocurrency, there are several ways to get started. You can purchase cryptocurrencies on online exchanges, which are platforms that facilitate the buying, selling, and trading of digital assets. Popular cryptocurrency exchanges include Coinbase, Binance, and Kraken.

Once you’ve acquired cryptocurrency, you’ll need a digital wallet to store it securely. Wallets come in various forms, including software wallets, hardware wallets, and paper wallets. Each type of wallet has its own advantages and security considerations, so it’s essential to choose one that best suits your needs.

The Future of Cryptocurrency

The rise of cryptocurrency has sparked a wave of innovation and speculation, with proponents touting its potential to revolutionize finance and disrupt traditional banking systems. However, cryptocurrency is not without its challenges and controversies, including regulatory uncertainty, volatility, and security risks.

Despite these challenges, many experts believe that cryptocurrency has the potential to transform various industries, from finance and banking to supply chain management and healthcare. As blockchain technology continues to evolve and mature, we can expect to see new applications and use cases for cryptocurrency emerge in the years to come.

In conclusion, cryptocurrency represents a groundbreaking development in the world of finance, offering a decentralized alternative to traditional forms of currency and payment systems. Whether you’re a seasoned investor or just getting started, understanding the basics of cryptocurrency is essential for navigating this exciting and rapidly changing landscape. As with any investment, it’s essential to do your research and exercise caution when buying, selling, or trading cryptocurrency. With the right knowledge and mindset, cryptocurrency has the potential to unlock new opportunities and reshape the future of finance for generations to come.

The Top 3 Platforms for Cryptocurrency Trading:

A Comprehensive Review.

Cryptocurrency trading has become increasingly popular in recent years, with a growing number of platforms offering access to a wide range of digital assets. To help you navigate the diverse landscape of cryptocurrency exchanges, we’ve compiled a list of the top three platforms for cryptocurrency trading, based on their features, security, liquidity, and user experience.

1. Binance

Binance is one of the largest and most popular cryptocurrency exchanges in the world, offering a comprehensive range of trading services to millions of users globally. Founded in 2017, Binance provides access to hundreds of cryptocurrencies, along with advanced trading tools and features.

Key Features:

- Extensive Range of Cryptocurrencies

- High Liquidity and Trading Volume

- Advanced Trading Tools (including spot trading, futures trading, and margin trading)

- Secure and Reliable Platform

Fees: Binance offers competitive trading fees, with discounts available for users holding its native cryptocurrency, Binance Coin (BNB).

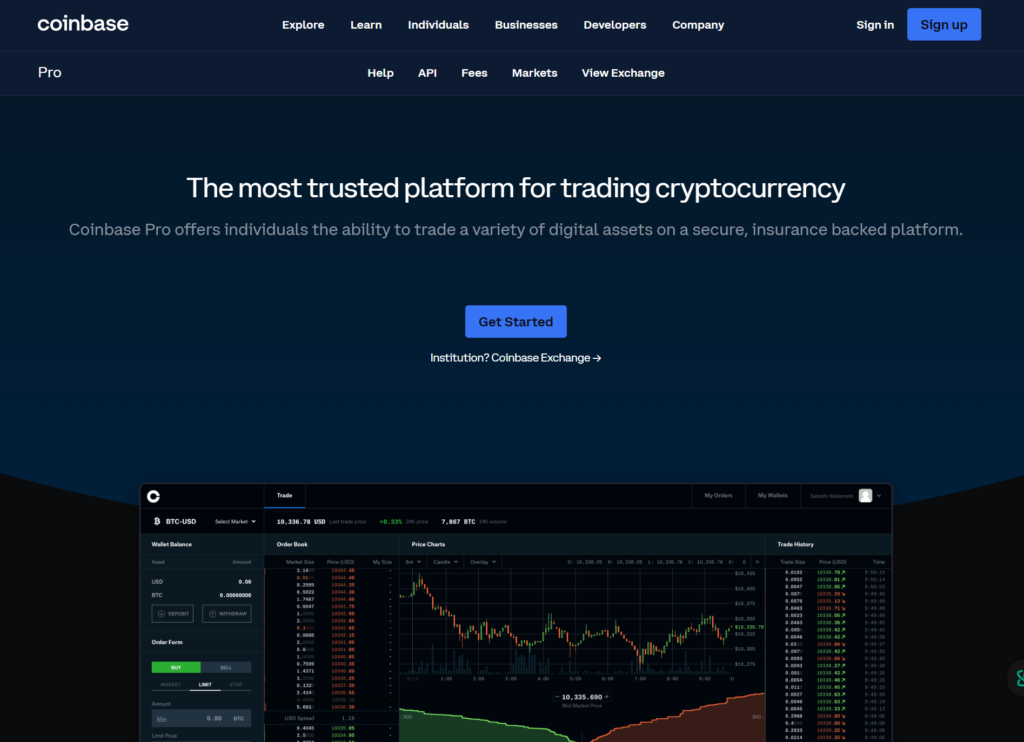

2. Coinbase Pro

One of the most reputable and widely used cryptocurrency exchanges in the United States offers Coinbase Pro, an advanced trading platform. Launched in 2015, Coinbase Pro provides professional traders with access to a select range of cryptocurrencies and trading pairs.

Key Features:

- Trusted and Regulated Platform

- User-Friendly Interface

- Deep Liquidity and High Security Standards

- Advanced Trading Features (including limit orders, stop orders, and charting tools)

Fees: Coinbase Pro charges competitive trading fees, which vary depending on the trading volume and order type.

3. Kraken

Kraken is a reputable cryptocurrency exchange known for its robust security features, extensive range of supported cryptocurrencies, and advanced trading options. Established in 2011, Kraken has earned a reputation for reliability and professionalism in the cryptocurrency industry.

Key Features:

- Wide Range of Cryptocurrencies and Trading Pairs

- Strong Security Measures (including cold storage and two-factor authentication)

- Advanced Trading Tools (including futures trading and margin trading)

- Regulatory Compliance and Transparency

Fees: Kraken offers competitive trading fees, with discounts available for high-volume traders.

Conclusion

Choosing the right platform is essential for successful cryptocurrency trading. Binance, Coinbase Pro, and Kraken stand out as top choices for traders seeking reliable, secure, and feature-rich platforms. Whether you’re a beginner or an experienced trader, these platforms offer the tools and resources you need to trade cryptocurrencies with confidence. Remember to consider factors such as supported cryptocurrencies, trading fees, security measures, and user experience when selecting the platform that’s right for you. With the right platform by your side, you can navigate the exciting world of cryptocurrency trading and capitalize on opportunities in the digital asset markets.

Leave a Reply